How to Prepare Financially for the Purchase of your First Home

/Purchasing a home is one of the biggest purchases you’ll make, so you want to make sure you are prepared. Often times people are ready for the purchase price and down payment of a home, but forget about the closing costs. The closing costs can be wrapped up into the mortgage or you can pay out of pocket for them. If you plan to pay out of pocket, that will lead to a slightly lower monthly mortgage. By paying your closing costs up front you won’t be paying interest on them for the life of the loan. So how do you prepare yourself financially for the purchase of your home?

A tool I recommend to anyone looking to purchase a home is Zillow Mortgage. This is a great tool that will help you estimate your monthly mortgage by taking into consideration your down payment, taxes, interest rate and insurance.

Once you have a good idea of what you are comfortable spending, I would create a budget sheet to verify your monthly expenses are compatible with your income and predicted mortgage rate. Include all expenses on your budget sheet so you have a realistic number. For example, if you get your hair cut or your nails done once a month, include this on your budget sheet. The last thing you want to be is house poor. What this means is, all your income goes into your home. If you are able to stick to the 50-30-20 rule you will be in good shape. This rule states that 50% of your monthly income goes towards housing and necessary (reoccurring) bills or utilities; 30% should go towards ‘wants’ such as dining or entertainment; and 20% should go towards your financial goals such as savings or paying off debt. If you are able to keep to this general outline, you will be in good shape.

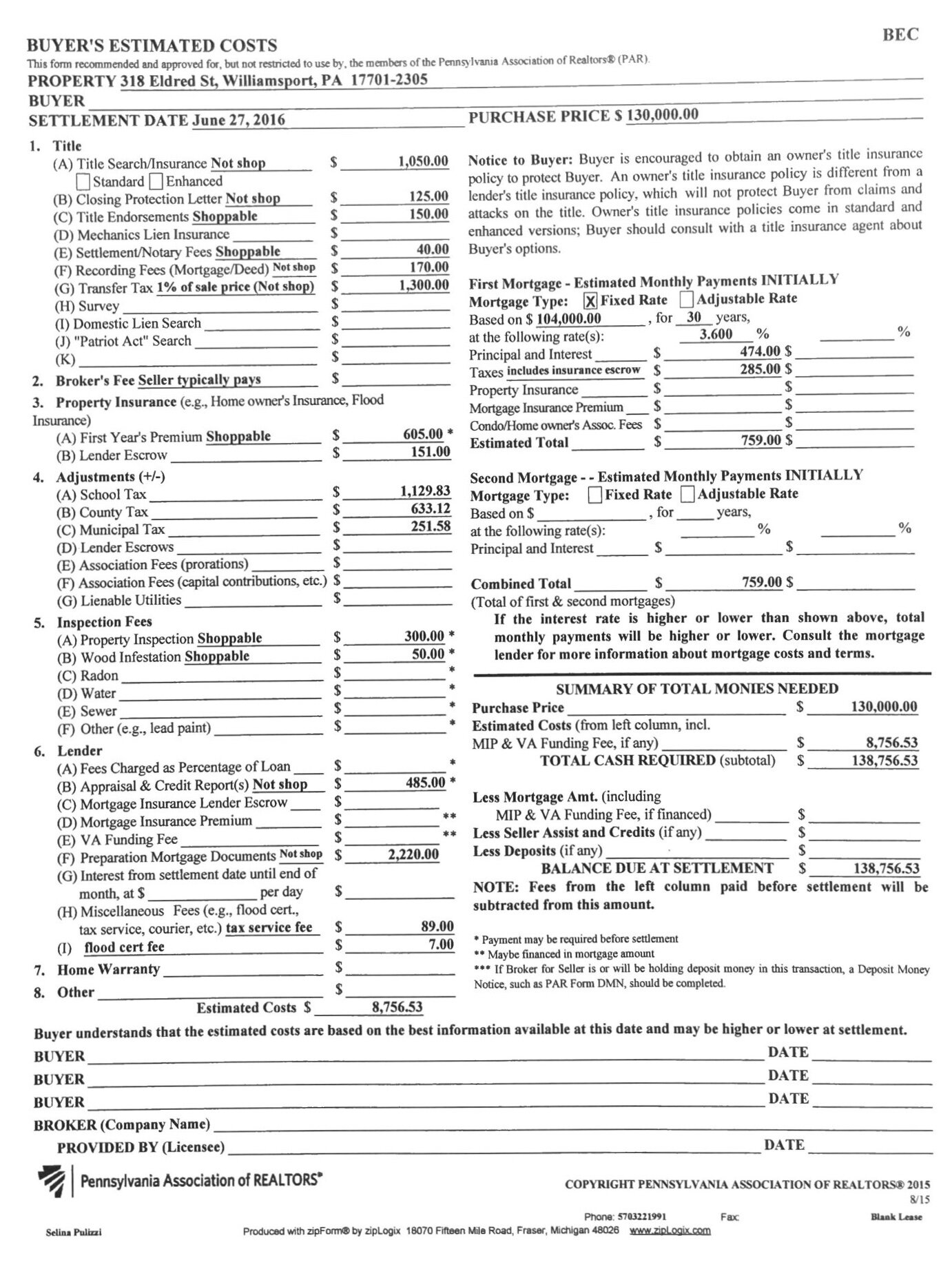

So you know what you can afford and you know how much you need to save, so the final kicker is closing costs. How do you know how much this will run? I would say on average, closing costs are going to be anywhere from 4% to 8% of the sale price. I have included a copy of our personal home closing cost fees to give you an idea of where the costs come from and why. Some of these fees are negotiable with the lender and some are not. It is definitely worthwhile to check with your lender regardless.

A lot of learning comes from doing. So once you have done the best you can to prepare, the rest is out of your hands. Just stay positive. Things won’t always swing in your favor, but if you are open to making the best of the situation you will always find a solution.